Higher cigarette taxes reduce child deaths—first global estimates

The primary world evaluation of its sort estimates that if each nation’s cigarette taxes had met the World Well being Group’s suggestions, round 182,000 new child deaths might have been averted in 2018.

Tobacco use can have direct and oblique results on kids’s well being. For instance, smoking throughout being pregnant could cause untimely start and publicity to second-hand smoke could cause lung circumstances like bronchial asthma.

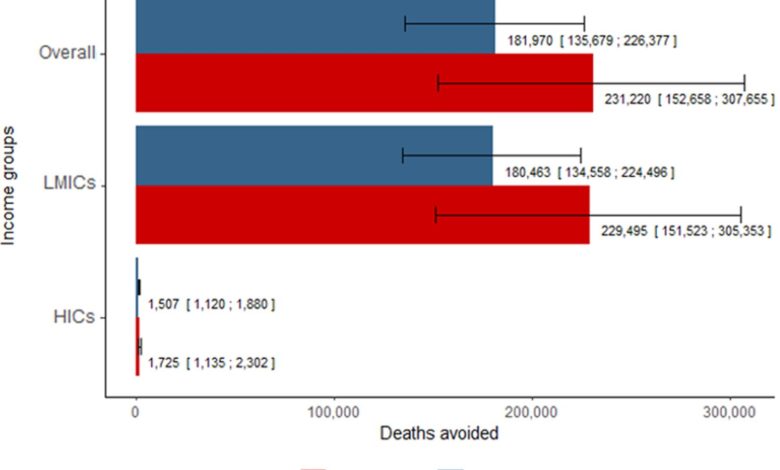

In whole, elevated cigarette taxes might have averted round 231,000 deaths of kids aged underneath a yr previous in 2018 (together with roughly 182,000 newborns), based on analysis led by Imperial School London and Erasmus MC and printed in PLOS International Public Well being.

Virtually all of those averted deaths can be in low- and middle-income international locations (LMICs). The researchers say that rising tobacco taxes in LMICs is important as this on common is the place the bottom ranges of tobacco tax are and the place the largest alternatives for youngster well being enhancements exist.

The WHO recommends that tax represents greater than 75% of the retail worth of tobacco merchandise, however in 2018 solely 14% of the world’s inhabitants lived in international locations which had achieved this.

Co-lead creator of the examine Dr. Anthony Laverty, from Imperial’s College of Public Well being, says: “Tobacco use has important and diverse ill-effects on kids’s well being. When infants are uncovered to smoking whereas within the womb, or uncovered to second-hand smoke within the dwelling after start, this could enhance the chance of well being issues early on, like untimely start and bronchial asthma. Equally, tobacco could cause important well being issues for fogeys who smoke, affecting their potential to earn a dwelling and their household’s wealth, which may not directly have an effect on a toddler’s well being. Robust world tobacco management is important to counter all of those causes, and to scale back the lots of of 1000’s of pointless youngster deaths we estimate are related to smoking.”

Senior examine creator, Dr. Filippos Filippidis, additionally from Imperial’s College of Public Well being, says: “Elevating tobacco taxes has been proven to be the simplest measure to scale back smoking, however most analysis is just in adults or high-income international locations. Previous research from high-income international locations have discovered that rising tobacco taxes reduces preterm start charges, bronchial asthma exacerbations and youngster deaths, however till now it was not clear if these findings will be utilized to low- and middle-income international locations the place there’s decrease consciousness of tobacco-related hurt, and the affect of the tobacco business is stronger and would possibly suppress the constructive results of elevating taxes.”

The brand new examine assessed the hyperlink between cigarette taxes and neonatal and toddler mortality in 159 LMICs and high-income international locations (HICs). It used each nation’s mortality and tobacco tax knowledge from 2008-2018. The examine doesn’t take a look at particular causes of demise related to tobacco.

The researchers additionally analyzed the outcomes primarily based on the kind of taxes used (total, as properly particular varieties of taxes, similar to particular cigarette taxes, worth added taxes and import duties). They notice that their examine didn’t take a look at total costs of cigarettes, so it might overlook how tobacco firms usually offset these taxes by decreasing the price of their merchandise.

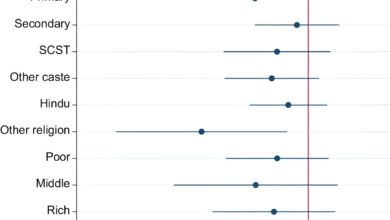

The researchers accounted for different associated variables together with gross home product, fertility fee, schooling and entry to ingesting water.

Worldwide between 2008-2018, the common neonatal and toddler mortality charges total have been estimated to be 14.4 and 24.9 deaths per 1,000 stay births, respectively. These charges have been increased in LMICs than HICs—with 33 kids aged underneath one (together with 19 newborns) in each 1,000 dying every year in LMICs, in comparison with 6 under-ones (together with 4 newborns) in each 1,000 in HICs.

As well as, the common tax on cigarettes was decrease in LMICs than in HICs between 2008-2018 (43% and 64% taxes, respectively), and fewer LMICs achieved the 75% tax stage beneficial by WHO in 2018 (11% of LMICs vs 42% of HICs).

The researchers estimate {that a} 10% enhance in tobacco taxation (ie, rising the general retail worth of cigarettes by 10%) can be linked to a 2.6% discount in new child deaths globally, and a 1.9% discount in deaths of kids aged underneath a yr previous.

This might equate to stopping round 78,000 deaths of kids underneath one, together with 64,000 new child deaths, worldwide in 2018.

The researchers discovered that will increase in all varieties of taxation have been related to advantages for youngster survival.

“Taxation can enhance the retail price of a packet of cigarettes, which could imply that individuals select to give up smoking because the behavior turns into dearer,” says Dr. Laverty.

Dr. Marta Rado from the Erasmus MC Rotterdam who co-led the examine says: “Making certain that kids develop up in a smoke-free surroundings ought to be a worldwide well being and human rights precedence.”

The researchers notice that their examine solely included knowledge on cigarette taxes and never on different types of tobacco, and relied on tax knowledge from the best-selling cigarette manufacturers from every nation.

The examine assumes that the affiliation between taxes and youngster deaths are comparable throughout completely different international locations, however the researchers notice that many elements can affect this, together with the prevalence of smoking, illicit tobacco commerce, availability of different tobacco merchandise and every nation’s healthcare insurance policies for kids.

Smokeless tobacco used extra by pregnant ladies in South East Asia than non-pregnant ladies

Radó MK, Laverty AA, Hone T, Chang Ok, Jawad M, Millett C, et al. (2022) Cigarette taxation and neonatal and toddler mortality: A longitudinal evaluation of 159 international locations. PLOS Glob Public Well being 2(3): e0000042. doi.org/10.1371/journal.pgph.0000042

Quotation:

Greater cigarette taxes cut back youngster deaths—first world estimates (2022, March 16)

retrieved 16 March 2022

from https://medicalxpress.com/information/2022-03-higher-cigarette-taxes-child-deathsfirst.html

This doc is topic to copyright. Other than any honest dealing for the aim of personal examine or analysis, no

half could also be reproduced with out the written permission. The content material is offered for info functions solely.