Medicare Advantage Poised To Take Off In 2022

The Biden administration in December 2021 launched new figures that confirmed greater than 27 million … [+]

ASSOCIATED PRESS

Search for much more seniors to flock to Medicare Benefit in 2022 because the Biden administration, well being insurers and buyers bolster this privatized type of well being protection for these 65 and older.

Already, established well being insurers together with UnitedHealth Group’s UnitedHealthcare, Humana, CVS Well being’s Aetna, Cigna and Anthem expanded into tons of of latest counties for this yr to promote Medicare Benefit on this more and more aggressive enterprise.

However there have already been indicators from annual well being insurer investor days and enterprise capital companies that Medicare Benefit will proceed taking a bigger share of seniors shifting away from conventional Medicare to those privatized MA plans in 2022 and past.

“We proceed to prioritize our high-growth markets,” CVS Well being chief govt officer Karen Lynch mentioned final month in the course of the firm’s annual investor day. “Particularly, in healthcare, we’re targeted on rising our authorities companies, twin eligibles, Medicare Benefit, change plans.”

CVS, which owns the nation’s third largest well being insurer in Aetna, has 3 million seniors enrolled in its Medicare Benefit plans. And these well being insurers see a market of greater than 10,000 People a day turning 65 years outdated and changing into eligible for Medicare and Medicare Benefit particularly.

Medicare Benefit plans contract with the federal authorities to supply additional advantages and providers to seniors, equivalent to illness administration and nurse assist hotlines with some additionally providing imaginative and prescient, dental care and wellness applications.

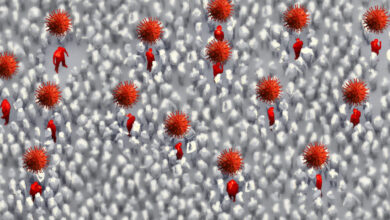

The Biden administration launched new figures final month that confirmed greater than 27 million People have been enrolled in a Medicare Benefit plan as of October 2021. That’s greater than 40% of the full Medicare enrollment of 63,964,675.

Startups and smaller well being plans are additionally gaining traction from buyers serving to them broaden in new markets for Medicare Benefit. These startups see a considerable market to work with to transform to a personal plan from conventional Medicare.

Take Zing Well being, a Chicago-based Medicare Benefit insurer, which its chief govt officer Dr. Eric Whitaker says is concentrated on creating “superior well being outcomes for seniors throughout underserved communities.”

More and more, well being insurers are working to deal with social determinants of well being and Zing sees a distinct segment in markets not traditionally served by Medicare Benefit.

Zing Well being final month landed a $25 million funding from City Corridor Ventures and Leavitt Fairness Companions, two funding companies targeted on healthcare progress firms. “This new infusion of capital will allow Zing to broaden its attain and proceed to supply the very best quality healthcare to underserved populations,” Zing mentioned in an announcement.